smartCoach

Coaching and advice to help get your contributions, insurance, and investments into shape. This service is included in your membership in the fund.

More cover

Comprehensive levels of cover1 for death and disablement at a competitive price.

Award winning

smartMonday has received multiple awards across our products and insurance offerings. One of these, Rainmaker, labelled us 'best practice' with a AAA Quality Rating after analysing our services, offers and features2.

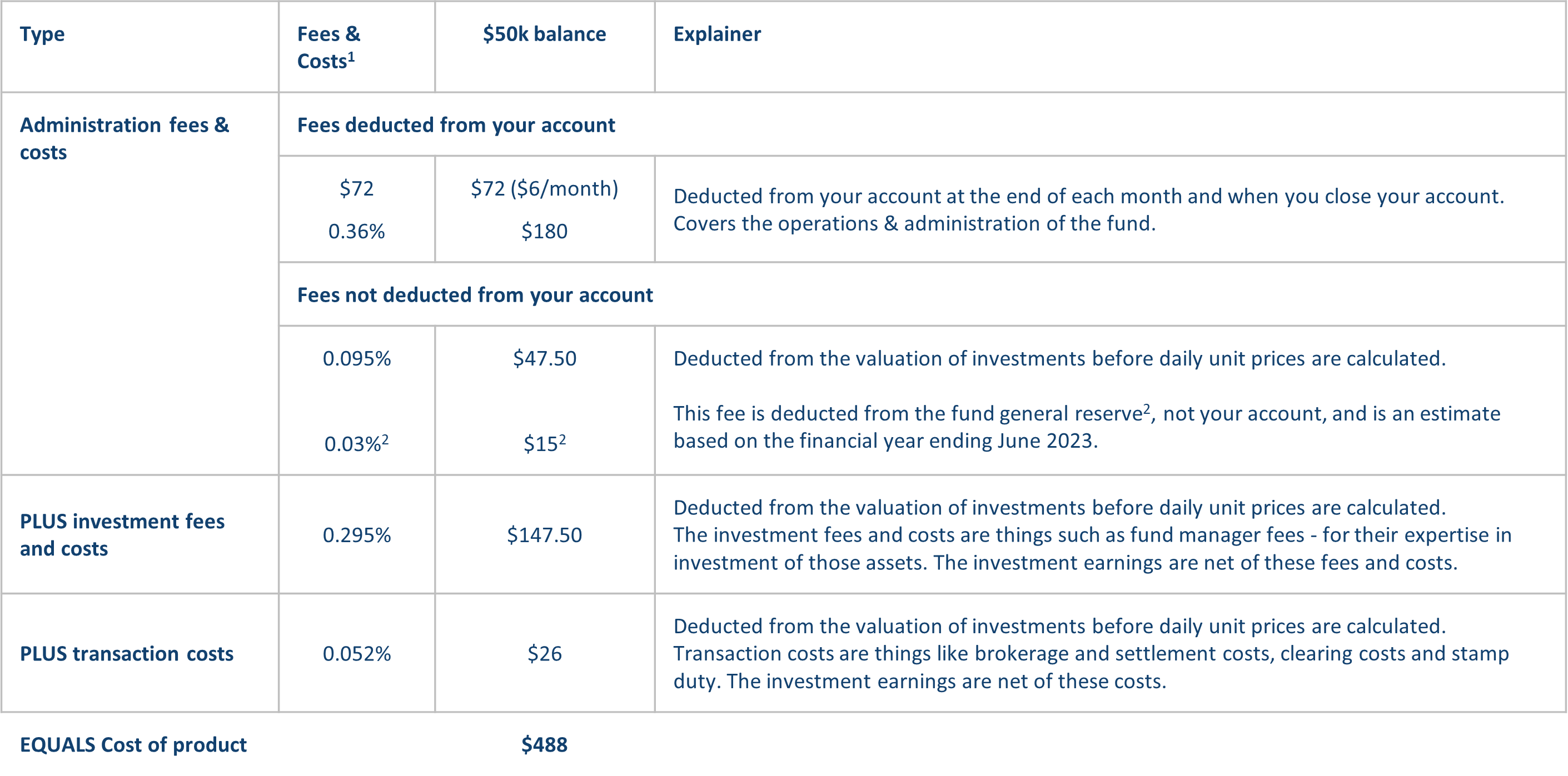

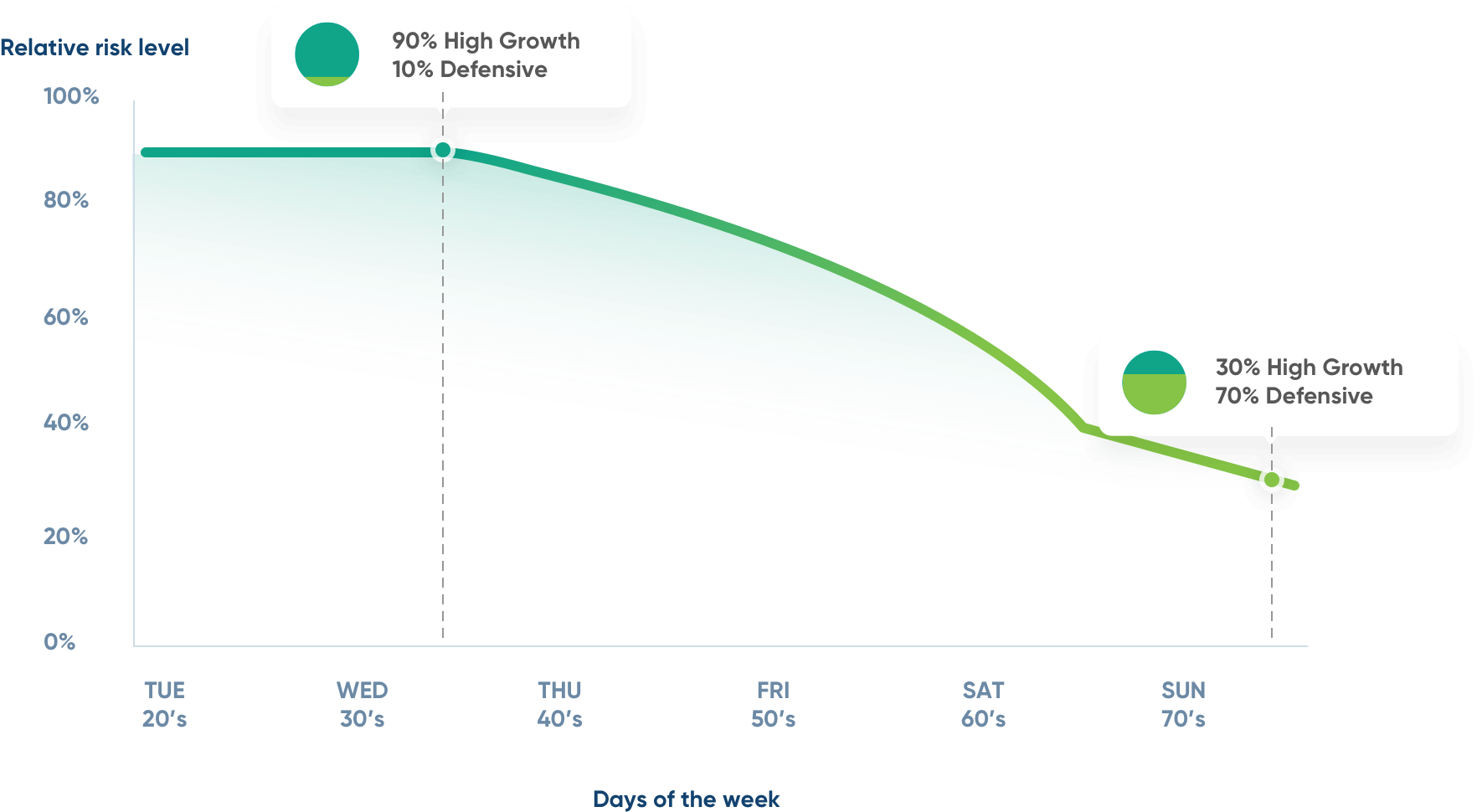

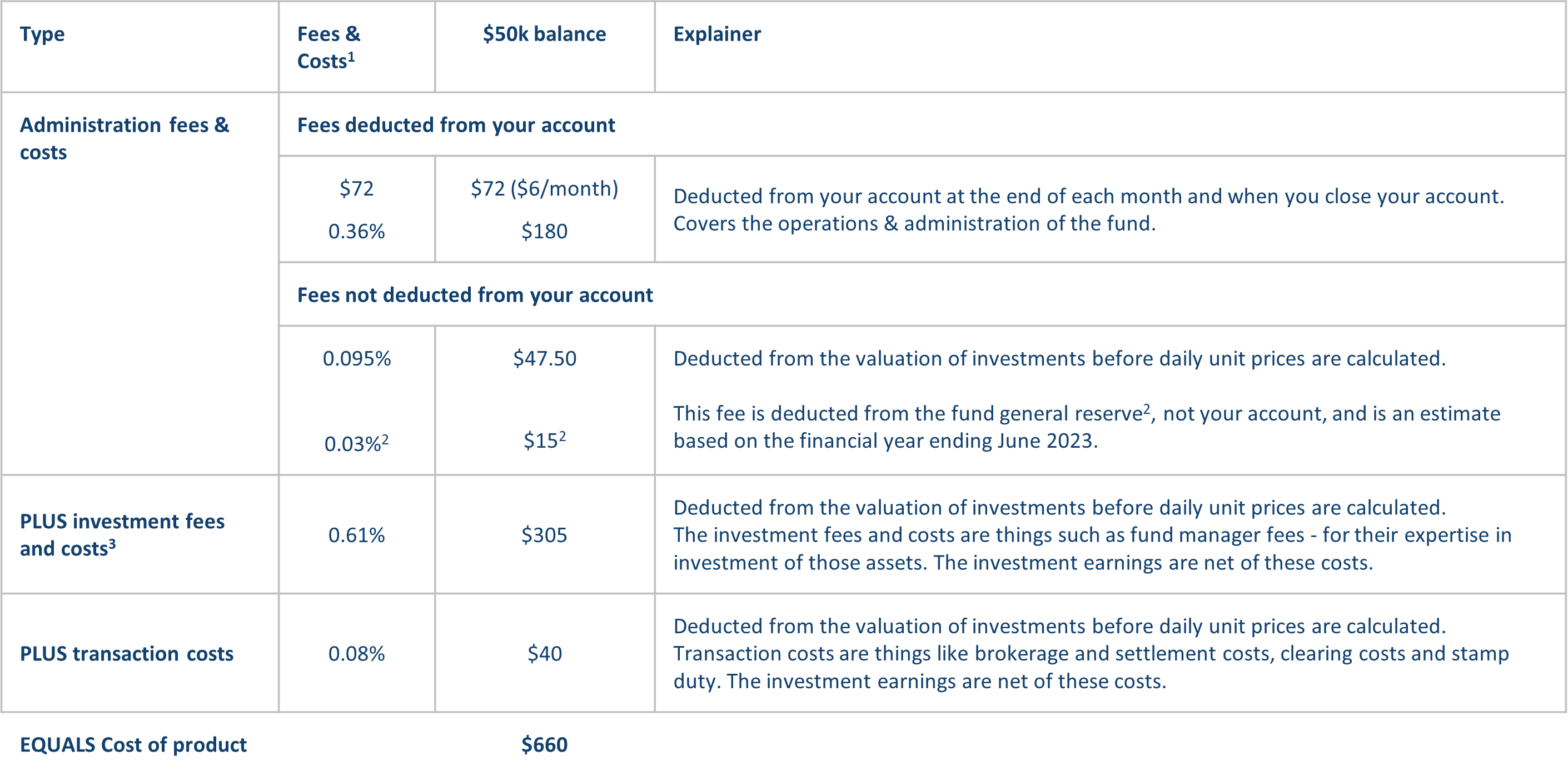

Select from our range of pre-mixed investment options – ranging from High Growth to Defensive, or our sector specific options - including Australian and International shares, Property, and Fixed Interest products. Or mix and match across both categories to suit your personal investment goals. See our Investment reference guide to find out more.

NEWS: smartMonday’s 'High Growth - Active' and 'Moderate - Index' investment options failed APRA’s 2022/2023 Your Future Your Super performance test. Visit this page for an explanation of what this means.

Pre-Mixed

Sector

Questions about fees, costs, or investments?

Talk to a smartCoach today on 1300 262 241 or email smartCoach@smartMonday.com.au

Why Monday?

smartMonday offers flexible, competitive insurance1 options that make it easy to protect your income and your family.

Generally , if you are eligible, insurance cover commences automatically2 when your account balance has reached $6,000 and you reach age 25. If you would like to turn on automatic cover earlier, simply opt-in online.

An income protection insurance benefit is paid as monthly income if an injury or illness temporarily prevents you from working.

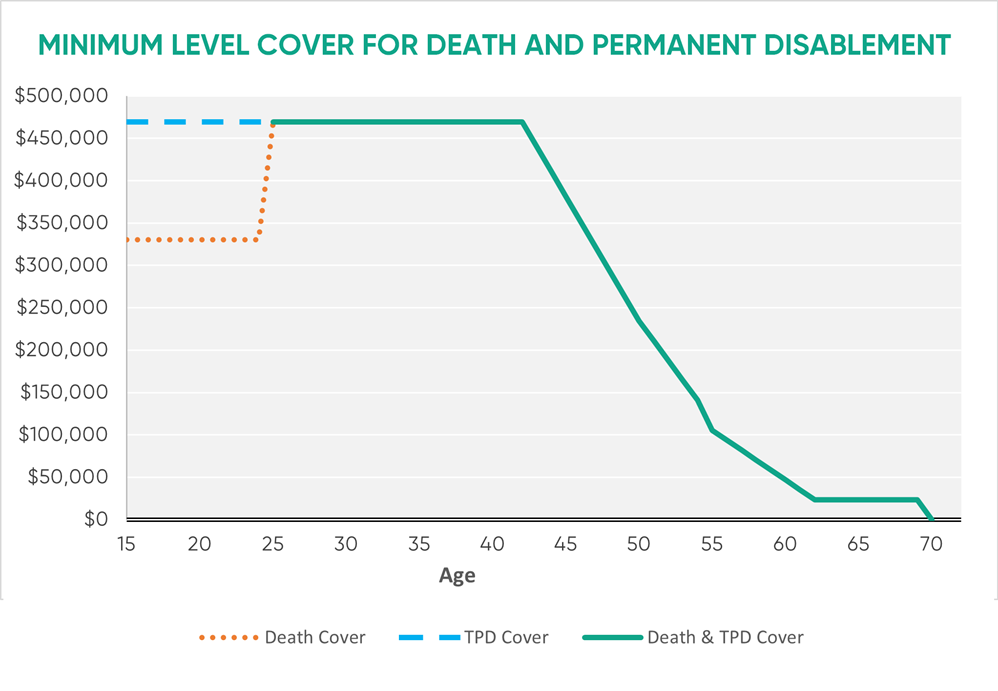

Subject to eligibility2, the amount of automatic death and TPD cover available to members in smartMonday is shown below. Casual employees can receive 25% of these minimum levels.

If eligible, permanent employees receive automatic2 insurance cover for:

See the PDS for eligibility criteria. You can modify or cancel your insurance cover at any time.

(Note: employees working less than 15 hours per week and casual employees are not eligible for automatic income protection cover. Age restrictions may also apply depending on the design of your employer plan).

Questions about insurance?

You can modify or cancel your insurance at any time by submitting a completed ‘Insurance changes’ form.

Talk to a smartCoach today on 1300 262 241 or email smartCoach@smartMonday.com.au

Want to join?

Complete a Choice of Fund form and hand it to your employer.